💰 Compound Interest Calculator

Calculate the power of compound interest on your investments

Compound Interest Results

Investment Breakdown

Investment Composition

Year-by-Year Breakdown

Compound Interest Calculator | See Your Money Grow

Calculate compound interest growth on savings and investments. See how your money can multiply over time with our free, powerful financial calculator.

Introduction

What if you could make your money work as hard as you do? Compound interest has been called the eighth wonder of the world for its ability to grow wealth exponentially. A compound interest calculator reveals the stunning potential of your savings and investments. This guide will show you how compound interest works and how our free tool can help you plan for financial freedom.

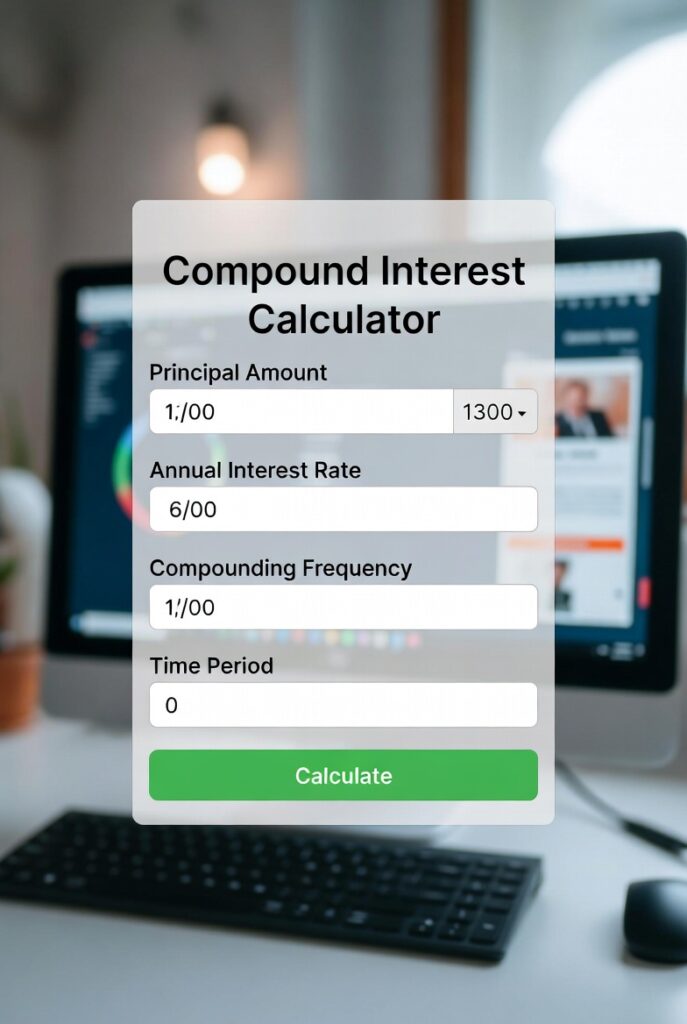

What is a Compound Interest Calculator?

A compound interest calculator is a financial tool that projects how your money grows over time when earnings reinvest. It shows the snowball effect of earning interest on both your principal and accumulated interest.

Our advanced calculator accounts for all key variables:

- Initial investment (principal amount)

- Regular contributions (monthly or annual)

- Interest rate (annual percentage)

- Compounding frequency (daily, monthly, annually)

- Time period (years of growth)

Why Understanding Compound Interest is Crucial

This fundamental financial concept impacts everything from savings accounts to retirement funds.

1. Retirement Planning

Starting early with compound growth can mean the difference between a comfortable retirement and financial stress.

2. Investment Strategy

Understanding compounding helps you evaluate different investment opportunities and time horizons.

3. Debt Management

Compound interest works against you with credit cards and loans, making debt more expensive over time.

4. Educational Savings

Parents can project college fund growth and ensure adequate savings for children’s education.

The Power of Compound Interest: Real Examples

See how small differences create massive long-term impacts.

The Early Starter Advantage

- Sarah invests $200 monthly starting at age 25

- 7% annual return, retires at 65

- Result: $525,000 portfolio

The Late Starter Challenge

- John invests $200 monthly starting at age 35

- Same 7% return, retires at 65

- Result: $244,000 portfolio

- Difference: 10 years cost $281,000!

Key Features of Our Compound Interest Calculator

Our tool provides comprehensive financial projections with clarity.

- Visual Growth Charts: See your money grow year by year

- Contribution Scenarios: Test different savings rates

- Inflation Adjustment: View real purchasing power

- Tax Considerations: Account for tax impacts

- Multiple Compounding Periods: Daily, monthly, quarterly, annually

How Compound Interest Works Mathematically

Understanding the formula helps you appreciate the calculator’s power.

The Compound Interest Formula

A = P(1 + r/n)^(nt)

Where:

A = Future value

P = Principal investment

r = Annual interest rate

n = Compounding periods per year

t = Years invested

Simple vs. Compound Interest

- Simple: Earns interest only on principal

- Compound: Earns interest on principal + accumulated interest

- Difference: Compound grows exponentially, simple grows linearly

Practical Investment Scenarios

Our calculator helps solve common financial planning questions.

Retirement Planning

- Current age: 30

- Goal: $1 million at 65

- Calculator shows: Need to save $650 monthly at 7% return

College Savings

- Newborn child

- Goal: $100,000 in 18 years

- Calculator shows: Need $225 monthly at 6% return

Wealth Building

- Starting with $10,000

- Adding $500 monthly

- 20-year projection: $260,000 at 7% return

How to Use Our Compound Interest Calculator

Getting your personalized projection takes just four steps.

- Enter Initial Investment: Input your starting amount

- Set Monthly Contributions: Add regular savings amount

- Adjust Interest Rate: Use realistic expected return

- Choose Time Horizon: Select years until goal

- View Detailed Results: See year-by-year growth projection

Maximizing Compound Growth: Smart Strategies

These approaches help you harness compound interest most effectively.

- Start Early: Time is your most valuable asset

- Be Consistent: Regular contributions build momentum

- Reinvest Earnings: Let dividends and interest compound

- Avoid Withdrawals: Don’t interrupt the growth cycle

- Increase Contributions: Boost savings as income grows

Conclusion

Compound interest is the most powerful force in building long-term wealth. A reliable compound interest calculator transforms abstract financial concepts into concrete, motivating projections. Whether you’re saving for retirement, education, or financial independence, understanding compound growth helps you make smarter decisions today for a prosperous tomorrow.

Ready to see your financial future? [Use our free Compound Interest Calculator now] and discover how your money can grow!

Checkout our new tool YouTube Title Generator here:

Frequently Asked Questions (FAQs)

How often should interest compound for maximum growth?

The more frequent, the better. Daily compounding yields slightly more than monthly, which beats annual compounding.

Is this compound interest calculator free?

Yes, completely free with no registration required. Use it as often as you need.

What’s a realistic interest rate assumption?

Historical stock market returns average 7-10% annually. Conservative investments yield 2-4%. Adjust based on your risk tolerance.

How does compound interest affect debt?

It works against you. Credit card debt compounds quickly, making balances grow faster than many investments.

How often should interest compound for maximum growth?

The more frequent, the better. Daily compounding yields slightly more than monthly, which beats annual compounding.

Is this compound interest calculator free?

Yes, completely free with no registration required. Use it as often as you need.

What’s a realistic interest rate assumption?

Historical stock market returns average 7-10% annually. Conservative investments yield 2-4%. Adjust based on your risk tolerance.

How does compound interest affect debt?

It works against you. Credit card debt compounds quickly, making balances grow faster than many investments.