Loan EMI Calculator

Single‑File • WordPress ReadyView Amortization Schedule

| Month | Payment | Interest | Principal | Extra | Balance |

|---|

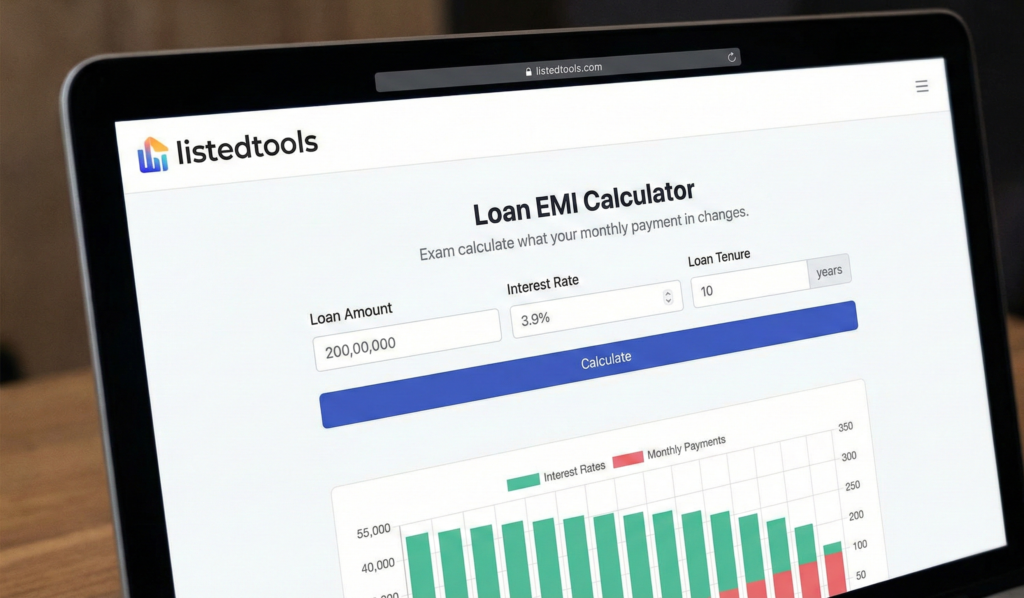

Loan EMI Calculator | Calculate EMI for Any Loan

Calculate your loan EMI instantly with our free calculator. Input loan amount, interest rate, and tenure to get accurate monthly payment estimates.

Introduction

Planning to take a home loan, car loan, or personal loan? Wondering how much your monthly payments will be and if they fit your budget? Understanding your Equated Monthly Installment (EMI) is crucial for smart financial planning. A loan EMI calculator provides instant, accurate calculations to help you make informed borrowing decisions. This guide will explain how EMI works and how our free tool helps you plan your finances with confidence.

What is a Loan EMI Calculator?

A loan EMI calculator is a financial tool that computes your fixed monthly loan payment based on the principal amount, interest rate, and loan tenure. It breaks down how much of each payment goes toward principal versus interest.

Our comprehensive calculator computes:

- Monthly EMI amount

- Total interest payable

- Total payment over loan term

- Principal vs interest breakdown

- Amortization schedule

Why EMI Calculation Matters

Accurate EMI planning is essential for financial health and borrowing decisions.

1. Budget Planning

Determine if monthly payments fit within your income and expenses.

2. Loan Comparison

Compare different loan offers from various lenders accurately.

3. Tenure Optimization

Choose the loan term that balances affordability and total interest cost.

4. Prepayment Planning

Understand how extra payments can reduce your loan term and interest.

Key Features of Our EMI Calculator

Our tool provides professional financial analysis with these user-friendly features.

- Real-Time Calculation: Instant results as you adjust inputs

- Detailed Breakdown: See principal vs interest allocation

- Amortization Schedule: View payment breakdown year by year

- Multiple Loan Types: Home, car, personal, education loans

- Export Options: Save or print your calculations

Common EMI Calculation Scenarios

Here are practical situations where our calculator provides immediate value.

Home Loan Planning

- Calculate affordable home loan EMIs

- Compare 15-year vs 30-year mortgage terms

- Plan for additional principal payments

Car Loan Decisions

- Determine monthly car payments within budget

- Compare loan offers from different banks

- Plan down payment amount for optimal EMI

Personal Loan Evaluation

- Check EMI for debt consolidation

- Calculate borrowing capacity for major purchases

- Plan loan repayment alongside other financial commitments

How to Calculate EMI in 3 Steps

Getting accurate loan payments is simple with our streamlined process.

- Enter Loan Details: Input amount, interest rate, and tenure

- Adjust Parameters: Experiment with different scenarios

- View Results: See detailed EMI breakdown and schedule

EMI Calculation Best Practices

Follow these guidelines for optimal loan planning and management.

Consider Total Interest

Look beyond monthly payments to understand the full cost of borrowing.

Account for Processing Fees

Include additional loan charges in your total cost calculation.

Plan for Rate Changes

For floating rate loans, calculate EMIs at potential higher interest rates.

Maintain Emergency Fund

Ensure you have backup funds for EMI payments during financial uncertainty.

Understanding EMI Components

Knowing what makes up your payment helps you make smarter decisions.

Principal Amount

The original loan amount you borrow, which decreases with each payment.

Interest Component

The cost of borrowing, highest at the beginning of the loan term.

Loan Tenure Impact

Longer terms mean lower EMIs but higher total interest costs.

Prepayment Benefits

Extra payments reduce principal faster and save significant interest.

Conclusion

Accurate EMI calculation is fundamental to responsible borrowing and financial planning. A reliable loan EMI calculator empowers you to make informed decisions about loan amounts, tenures, and lenders by providing clear visibility into your monthly commitments and total borrowing costs. Whether you're planning a major purchase, consolidating debt, or comparing loan offers, understanding your EMI ensures you borrow wisely and maintain financial stability throughout your repayment journey.

Ready to plan your loan? [Use our free Loan EMI Calculator now] and make informed borrowing decisions with accurate payment estimates!

- "An Equated Monthly Installment (EMI) is a fixed payment amount made by a borrower to a lender at a specified date each calendar month."

Frequently Asked Questions (FAQs)

Is this EMI calculator completely free?

Yes, 100% free with no usage limits, registration requirements, or hidden costs.

How accurate are the EMI calculations?

Our calculator uses standard financial formulas and provides precise results matching bank calculations.

Can I calculate EMIs for different loan types?

Yes, our tool works for home loans, car loans, personal loans, and education loans.

What's the difference between reducing balance and flat interest rates?

Reducing balance calculates interest on remaining principal, while flat rate calculates on original amount throughout.

Is this EMI calculator completely free?

Yes, 100% free with no usage limits, registration requirements, or hidden costs.

How accurate are the EMI calculations?

Our calculator uses standard financial formulas and provides precise results matching bank calculations.

Can I calculate EMIs for different loan types?

Yes, our tool works for home loans, car loans, personal loans, and education loans.

What's the difference between reducing balance and flat interest rates?

Reducing balance calculates interest on remaining principal, while flat rate calculates on original amount throughout.